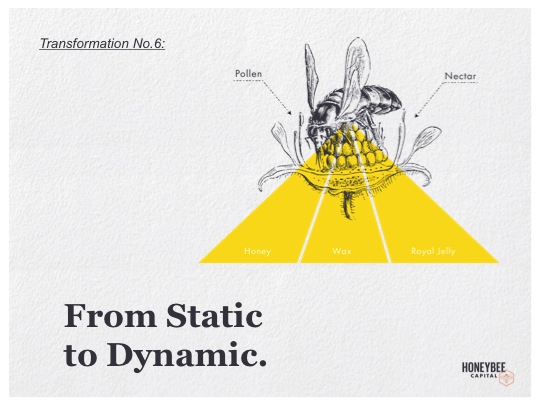

Honeybee Capital Transformation #6: From Static to Dynamic

Dear Honeybees,

As we transition into a new season, I’m happy to present the finale of our second graphic blog series, which illustrates the six transformations of finance that form the core of The Nature of Investing. These ideas have emerged from the six sets of principles of biomimicry – the natural guides to life itself. When taken together, these six evolutions illuminate a path towards investing that is reconnected, resilient and regenerative, in service to life.

-Katherine Collins

* With great thanks to the Guts and Glory team for the fantastic design work!

#6: FROM STATIC TO DYNAMIC

Our final transformation, from static to dynamic, is related to natural principle “evolve to survive”. This might sound self-explanatory – survival, duh! But like our other principles, it’s the HOW that’s really important.

- Replicate what works

- Integrate the unexpected

- Reshuffle information

Let’s consider each of these ideas.

Replicate what works.

A great example of replicating what works is the horseshoe crab. This organism has looked almost the same for millions of years now, partly because it works! The spiny navigator, the hard shell, the multiple eyes…these actually suit the crab and its environment very well. So you don’t want to skip what is going well, you want to nurture and perpetuate it. Yet I’ve read a thousand articles on innovation and disruption this year, and I can’t recall a single one on replicating what works (unless you count advice on “scaling,” which is something else altogether). Sometimes in our business and investing endeavors – and in our lives – we’re so focused on looking for something shiny and new that we forget to appreciate what is already pretty great.

Integrate the unexpected.

When something happens that we don’t anticipate, instead of just trying to get through it, or to dismiss it once the storm has passed, the idea of evolution is to integrate that occurrence into our knowledge and into our ongoing evolution. How can we incorporate the storms, rather than just weathering them?

Reshuffle information.

This is especially important – renewal, yeah! In natural systems, reshuffling mainly happens through reproduction, so there is a constant stream of new and different DNA and genetic mutation over time. The snowshoe hare is a great example of this sort of reshuffling. When the first hare with giant feet came along, she was a big weirdo. And yet that rabbit was able to survive much better in the snow because of those large feet, so over time the “snowshoes” became a standard feature of the species.

In my own investing, sometimes I settle in on a key set of indicators and become more and more tightly wound up with them over time, closed-off to new inputs. For all investors, chances are you’ve checked the price of your holdings sometime very recently (like, the last 10 minutes?). Price is one important indicator, but I’m curious: what are the other indicators that may be just as valuable to you? Maybe they’re a little bit harder to find, but maybe they also provide valuable information that you wouldn’t get any other way.

If you only go to investing conferences and read investing magazines and vacation with other investors and talk about investments at cocktail parties, your world is a lot more narrow than you might intend it to be. Fortunately, the antidotes are both easy and fun: reading extensively, going to crazy places where you might observe something that’s unfamiliar or learn something that’s unplanned, or talking with folks who don’t care one bit what happened in the stock market that day, can be indirect but very powerful sources of information over time. This is where the real insights come from, when you bring in information and perspectives that are genuinely new. It’s true for the evolution of natural systems, it’s true for business and investing… it’s true for life.

We can foster pollination through openness.

We can shift from static to dynamic.