Finance Friday – February 17, 2017

Someone’s sitting in the shade today because someone planted a tree a long time ago.

– Warren Buffett

Everyone thinks businesses (and investment portfolios) should be managed for the long term…. until there’s a bad quarter. The pressures of short termism have been widely noted, but now there is some empirical proof that longer term management really does pay off.

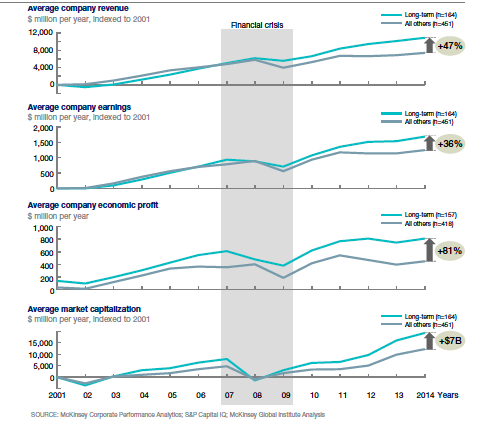

A recent McKinsey report, written with FCLT Global and cited in the Harvard Business Review, found that, for the average company managed with a long-term horizon:

- Earnings growth over a 15-year period was 36% greater than short-term peers.

- Revenue growth was 47% greater.

- R&D was higher during the economic crisis, and revenue and earnings declines were smaller (though share prices, curiously, were hit harder).

- Economic profit was 81% greater.

- Market cap increased an additional $7 billion.

- Job creation was 12,000 higher.

I know, I know, your analytical brains are lighting up with questions, and rightly so!

- Yes, it was solid methodology (and interesting): they looked at investment levels, earnings quality, margin and earnings growth, and quarterly targets over a 15 year period… all relative to industry peers. This was not a simple sort-the-spreadsheet exercise.

- Yes, it was a good sample set: altogether the study covered 615 public companies with market caps over $5b, about 60-65% of total US market cap.

- Yes, these results show correlation, not causality.

- Yes, there are still lots of questions to explore.

If a company is like a garden, sure, you want some pretty annuals to brighten the current season. But it’s those shade trees that really matter over time.

Here is the summary HBR article and here is the full report from McKinsey.

Mail Click

Join Our Mailing List